Donerail Issues Open Letter to MarineMax Shareholders

Calls Out Board Entrenchment, Nepotism, and Obstruction of Shareholder Engagement

Urges Shareholders to Vote AGAINST CEO Brett McGill as a Director at Company's Upcoming Annual Meeting

Reaffirms $35.00 per Share All-Cash Proposal as a Path to Providing Immediate Shareholder Value at Significant Premium

LOS ANGELES, Feb. 09, 2026 (GLOBE NEWSWIRE) -- The Donerail Group ("Donerail"), one of the largest shareholders of MarineMax, Inc. (NYSE:HZO) ("MarineMax" or the "Company"), beneficially owning over 4% of MarineMax's outstanding shares, today issued an open letter to the Company's shareholders further discussing its $35.00 all-cash offer to acquire the Company, its recent engagement with the Company, and its intention to vote AGAINST the election of CEO Brett McGill as a Director at the Company's upcoming 2026 Annual Meeting scheduled to be held on March 3, 2026.

The full text of the letter follows:

February 9, 2026

Dear Fellow MarineMax Shareholders -

The Donerail Group (together with its affiliates, "Donerail" or "we") is one of MarineMax, Inc.'s ("MarineMax" or the "Company") largest shareholders, beneficially owning over 4% of the Company's outstanding shares. We are writing to shareholders today to ensure the full record of the Company's Board of Director's (the "Board") conduct over recent months is clearly understood.

Over the past seven months, we have made repeated good-faith efforts to engage in a private, constructive dialogue with management and the Board to unlock value for all shareholders. Those efforts have been met with silence, procedural maneuvering, and outright obstruction.

Over an eight-week period during the summer of 2025, we made nine separate requests to meet with the Board – all were ignored. Our proposals to the Board in a September private letter were left unanswered. In November, when we took the extraordinary step of nominating three highly qualified directors to provide shareholders with a genuine alternative to the status quo, the Board chose to shamelessly invalidate our nomination rather than allow shareholders to choose their own representatives in a fair and open election.

Last month, with the support of leading global institutional investors, we submitted an all-cash proposal to acquire 100% of the Company at a meaningful premium over the Company's 60-day volume-weighted average price of $25.451, subject to confirmatory due diligence, which we believe would provide immediate and significant value to shareholders.

In our non-binding offer letter to the Board, we made clear our willingness to increase our offer price if warranted based on diligence which we could conduct expeditiously. Since submitting our proposal to the Board on January 13, 2026, and a more detailed proposal on February 1, 2026, the Company has not offered any productive engagement.

Donerail's interest in MarineMax is neither theoretical nor tactical. We are fundamental investors who believe the Company has substantial intrinsic value under proper stewardship. The Board's continued refusal to meaningfully engage with us – now nearly a month after receiving our initial proposal – speaks for itself.

This is not governance. It is entrenchment.

Based on these events and our recent engagement with the Company, it is clear to us that MarineMax's Board has become captive to its CEO, Brett McGill, and is unwilling to act independently while he remains in the boardroom – a dynamic reinforced by a culture of nepotism that insulates management from accountability. If this conduct continues, we believe shareholders will remain trapped in a value-destructive status quo – saddled with a failed manager and a Board that has chosen entrenchment over accountability.

At the Company's upcoming Annual Meeting scheduled to be held on March 3, 2026, shareholders have the opportunity to send a clear message to the Board that accountability matters – and that nepotism and a blatant disregard for fiduciary duties is intolerable.

We will be voting AGAINST the election of Brett McGill as a Director at the Company's 2026 Annual Meeting, and we urge every shareholder to do the same.

A Culture of Nepotism Has Impaired Governance and Accountability at MarineMax

MarineMax is being run as a family enterprise, not a public company. The culture of nepotism at the Company is not abstract – it is visible, documented, and corrosive to accountability.

The Company is led by the founder's son, Brett McGill, who appears to be protected by a Board Chair whose appointment was actively championed by Mr. McGill's father himself, and enabled by a Board that has seemingly prioritized loyalty over fiduciary duty.2 That protection has not been costless: the Chair's compensation from MarineMax materially exceeds her compensation in her primary professional role, creating incentives that are difficult to reconcile with genuine independence.3 The result is an organization in which independence, meritocracy, and accountability have been systematically eroded.

Employee feedback and industry commentary reinforce this reality. Public Glassdoor and Indeed reviews describe a workplace "rife with nepotism," and a company that, "will advance and support certain family members ahead of others", and which is a "very big company still run like a ‘mom and pop' boat dealership." 4 Other reviews explicitly call out favoritism in promotions, titles and compensation, noting that advancement often bears little relationship to responsibility or performance.

This culture extends beyond perception. Based on publicly available information, two of Mr. McGill's sons are currently employed by MarineMax – one as an In-House Service Advisor and another as a Detail Specialist – with a third son previously employed as a Sales Coordinator. In addition, the Company disclosed it had paid approximately $293,156 to the son of its Chief Financial Officer.5 Publicly available professional profiles further indicate that other senior members of MarineMax's leadership team, including executives overseeing digital, accounting, and legal functions, have also employed their immediate family members at the Company.6

Taken together, these facts reflect a broader pattern of family employment across senior leadership functions – a pattern inconsistent with the governance standards expected of a public company. In our decades of analyzing and assessing public companies, we have rarely seen a public company of MarineMax's size and complexity exhibit such pervasive family employment across senior leadership roles without meaningful Board oversight.

Employing family members may be common in privately held businesses. In a publicly traded company, however, nepotism is not a cultural quirk – it is a governance failure. When combined with prolonged business underperformance, weakened margins, repeated strategic missteps, and a breakdown in shareholder trust, this failure raises serious concerns about the Company's governance framework. To that end, we believe it is clear that MarineMax is being managed to preserve a family legacy rather than maximize shareholder value; this also helps explain why meaningful accountability has been absent at the highest levels of leadership.

This culture of nepotism has not merely impaired governance – it has produced catastrophic outcomes for MarineMax stockholders.

Brett McGill's Track Record: Promises Broken and Value Destroyed

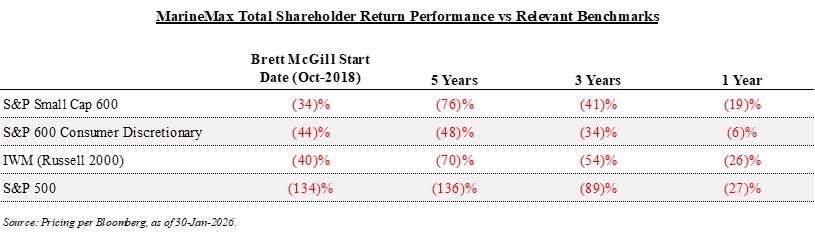

It is clear to us that there is no practical basis to believe that Mr. McGill can create value for shareholders. Over the last half decade, MarineMax shares are down over 35%, and the Company's most recent earnings call left shareholders uninspired, with the stock closing down more than 8% on the day.7 Management's investment decisions have resulted in substantial write-downs, operating margins have contracted far beyond management's own stated expectations, and the stock has dramatically underperformed broader indices.8,9 Under Mr. McGill's leadership, shareholders have experienced sustained and significant underperformance.

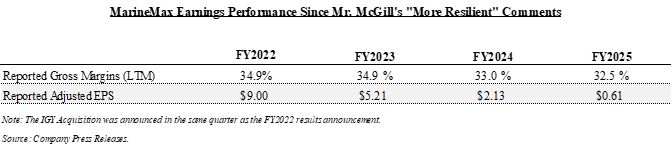

Since the Company's "bet-the-company" acquisition of Island Global Yachting ("IGY") in the fourth quarter of 2022, Mr. McGill's failure to execute has become empirically clear. In the 13 quarters following the acquisition, MarineMax has missed quarterly earnings expectations 62% of the time, while forward guidance was cut in nearly half of those announcements.10 In October 2022, shortly after the acquisition of IGY was announced, Mr. McGill told investors that MarineMax would be "more resilient" because of the transaction and that the Company's "higher gross margin profile has elevated MarineMax's earnings power to withstand a choppy economic cycle." 11

He was wrong.

In the three years since the IGY announcement, gross margins have contracted materially, Adjusted EPS has collapsed from approximately $9.00 per share to less than $1.00 and – prior to the news of Donerail's proposal – the Company's stock had declined over 30%.12 The IGY acquisition did not make the Company more resilient; rather, it distracted management attention from its core retail operations, increased leverage, and added undue risk to shareholders. In his current role, we believe Mr. McGill is a risk to shareholders.

Compounding this misalignment, it appears Mr. McGill has consistently treated MarineMax less like a long-term ownership opportunity and more like a personal liquidity vehicle. Over the past 13 years, he has sold an average of 62% of the equity granted to him in 12 of those years.13 In fact, there was only one year in which he did not sell at least 39% of the MarineMax stock issued to him, and last year, he sold 91%.14 Today, Mr. McGill beneficially owns approximately 1% of the Company – materially less than Donerail, and of a similar value to just a single year of his CEO compensation.

Shareholders should ask themselves: do these actions reflect the mindset of a CEO entrusted with long-term value creation on behalf of all shareholders?

What we see at MarineMax is a pattern that has no place in a modern public company: merit replaced by lineage, accountability replaced by loyalty, urgency replaced by complacency – and shareholders absorbing the consequences of unchecked nepotism. Shareholders deserve better. We deserve a Board that acts like owners and not simply as caretakers of an eroding family legacy.

The Path Forward: Leadership Change and a Real Strategic Process

The evidence now compels a simple conclusion: the current CEO cannot be the steward of the Company's future, and the Board must finally allow a real strategic process to determine its best path forward.

At the Company's Annual Meeting on March 3, 2026, shareholders face a clear choice.

A vote FOR Brett McGill is a vote to preserve the current governance structure, the current leadership, and the trajectory that has produced sustained underperformance and diminished shareholder confidence.

A vote AGAINST Brett McGill is a vote to reestablish accountability at the Board level and to enable a credible, independent strategic process designed to maximize value for all shareholders.

Donerail is not proposing theory – we are proposing action. With the support of leading global institutional investors, and subject to confirmatory diligence, we reaffirm our previously announced $35-per-share all-cash proposal to acquire MarineMax in full. We stand ready to engage immediately, deploy additional capital if warranted, and participate constructively in a bona fide strategic review designed to deliver certainty and value to shareholders.

Should Mr. McGill fail to receive majority shareholder support for his re-election as a Director, it would constitute a clear vote of no confidence in his leadership and, in our view, he should promptly step down as Chief Executive Officer. In that event, we believe it would be prudent and stabilizing for the Board to appoint the Company's current Chief Financial Officer, Michael McLamb, as interim CEO while a comprehensive strategic review is undertaken. Mr. McLamb is a long-tenured and seasoned executive with deep knowledge of MarineMax's operations and financial position and would help ensure leadership continuity and operational stability during a transition period.

As always, we remain open to engaging with MarineMax to reach a constructive solution on behalf of all shareholders. We look forward to continuing our discussions with our fellow shareholders in the coming weeks.

Sincerely,

/s/ William Wyatt

William Wyatt

Managing Partner

The Donerail Group

About Donerail

Founded in 2018, The Donerail Group is a strategic, value-add investor and advisor that partners closely with management teams and boards to unlock shareholder value, combining hands-on engagement with creative capital solutions, bespoke transaction structures, and integrated M&A advisory to drive superior outcomes.

THIS IS NOT A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. DO NOT SEND US YOUR PROXY CARD. DONERAIL IS NOT ASKING FOR YOUR PROXY CARD AND WILL NOT ACCEPT PROXY CARDS IF SENT. DONERAIL IS NOT ABLE TO VOTE YOUR PROXY, NOR DOES THIS COMMUNICATION CONTEMPLATE SUCH AN EVENT.

1 Bloomberg. Volume-Weighted Average Price calculated over all trading U.S. trading days from November 5, 2025, to February 2, 2026.

2 Company SEC filings. En Factor Podcast. 3-Feb-2021. Bill McGill described personally championing the appointment of Dr. Rebecca White to the Board, while the remaining directors initially rejected her candidacy due to suitability concerns. He stated that his repeated advocacy ultimately led to her appointment. Dr. White later became Chair following Mr. McGill's retirement.

3 Public tax filings. University of Tampa. Dr. Rebecca White's compensation listed at $267,530 versus MarineMax's 2026 proxy statement detailing her 2025 compensation of $385,009 (see page 42).

4 Glassdoor and Indeed reviews for MarineMax from 2018 – 2024.

5 Company 2025 and 2026 proxy statement disclose compensation of $151,646 in FY2025 and $141,510 in FY2024.

6 Company SEC filings; Donerail Research

7 Pricing per Bloomberg. Measurement taken between January 29, 2021, and January 30, 2026, the trading day prior to Donerail's proposal becoming public.

8 For the year ended September 30, 2025, MarineMax reported a goodwill impairment charge of $69.1 million, accounting for 54% of the enterprise value of the product manufacturing segment's acquisitions since 2021.

9 Pricing per Bloomberg and data shown herein.

10 The IGY acquisition closed in Q4 2022. In the 13 reporting quarters that followed, MarineMax missed Adjusted EPS earnings in 8 of 13 quarters (1Q 2023, 2Q 2023, 4Q 2023, 1Q 2024, 2Q 2024, 4Q 2024, 3Q 2025, 1Q2026) and lowered guidance in 6 quarters (1Q 2023, 2Q 2023, 1Q 2024, 2Q 2024, 2Q 2025, 3Q 2025), per Bloomberg.

11 MarineMax 4Q 2022 earnings call. October 27, 2022.

12 Bloomberg. Company SEC filings.

13 Company and Brett McGill SEC filings.

14 Company and Brett McGill SEC filings.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2df9cfc5-69bd-4358-8b25-6c44ca51cde4

https://www.globenewswire.com/NewsRoom/AttachmentNg/4d307330-ed5f-4af4-85df-bb3fc1cdcb1a

CONTACT Nancy Lin (310) 289-2345