Omdia: Mainland China's cloud infrastructure market accelerates to 24% growth in Q3 2025

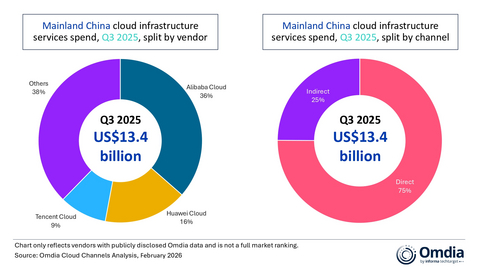

According to Omdia, Mainland China's cloud infrastructure services market reached $13.4 billion in Q3 2025, growing 24% year on year. This marked the second consecutive quarter of growth above 20%. Sustained AI demand continued to drive adoption while generating spillover effects across core cloud infrastructure services, accelerating the shift in cloud resource consumption toward production workloads. In response, leading cloud providers continued to build out AI capabilities. They also placed greater emphasis on the productization and role differentiation of models, while strengthening the toolchains that underpin AI agent platforms. In Q3 2025, the market shares of Alibaba Cloud, Huawei Cloud, and Tencent Cloud were 36%, 16%, and 9%, respectively.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260209034854/en/

Mainland China cloud infrastructure services spend, Q3 2025

In Q3 2025, Mainland China's cloud infrastructure services market continued to rebound, with year-on-year growth reaching 24%. As enterprises moved beyond early-stage AI experimentation toward broader adoption, AI increasingly drove incremental demand for core cloud infrastructure services, including compute, storage, and database.

"As AI adoption deepens, leading cloud vendors are complementing ongoing improvements in foundation model capabilities by positioning these models as functional components within a broader platform stack," said Rachel Brindley, Senior Director at Omdia. "Clearer role definition and tighter platform integration are becoming an increasing focus."

During the quarter, Alibaba Cloud expanded its multimodal model portfolio; Huawei Cloud accelerated AI adoption in core industry use cases through the co-launch of industry models; and Tencent Cloud clarified model role differentiation within its Hunyuan 2.0-based HY 2.0 Think and Instruct lineup.

As AI deployments scale into production, enterprise priorities are shifting toward platform-level reliability and operational stability. "Individual model performance alone is no longer sufficient to meet enterprise needs in real-world use cases," said Yi Zhang, Senior Analyst at Omdia. "The central challenge in scaling AI initiatives lies in orchestrating models, data, tools, and workflows within complex systems in a way that enables reuse, operationalization, and commercialization."

Against this backdrop, leading cloud providers showed increasing convergence in AI Agent platform strategies in H2 2025. Alibaba Cloud, Huawei Cloud, and Tencent Cloud all began advancing their agent development platforms beyond capability demonstration toward a more engineering-led, operationally scalable stage, with systematic upgrades across MCPs, workflows, knowledge bases, and plugin frameworks supporting this shift. These developments are laying the groundwork for the commercialization of generative AI.

In Q3 2025, partner-driven cloud revenue represented 25% of the market, with the share expected to grow further as ecosystem collaboration plays a larger role in translating AI adoption into business value.

In Q3 2025, Alibaba Cloud increased its market share to 36%, maintaining its leadership in China's cloud infrastructure services market. AI-related revenues have recorded triple-digit growth for nine consecutive quarters. This has been supported by expanding enterprise adoption and strategic AI partnerships with Marriott, GAC Group, L'Oréal China, and Haier across key industry verticals. Alibaba Cloud's recent AI upgrades have focused on application enablement and platform usability across its Qwen model family. In October, it released nine Qwen3-VL multimodal models, strengthening video understanding and spatial perception capabilities. This was followed by the launch of the Wan2.6 video generation series, including Wan2.6-R2V, China's first reference-to-video generation model, advancing video generation toward production-grade deployment. In December, it introduced AgentRun, a serverless-based service designed to support production-grade deployment and operation of AI agents. On the global infrastructure front, it continued to expand its global footprint, bringing its second data center in Dubai online in October.

Huawei Cloud maintained its position as the second-largest cloud infrastructure services provider in China in Q3 2025, reporting stable performance with year-on-year revenue growth of 14% and a market share of 16%. During the quarter, Huawei Cloud continued to advance AI adoption in industry settings, co-launching the Tianji Predictive Model 1.0 with China Southern Airlines. Built on Huawei Cloud Stack and AI-driven predictive capabilities, the model exemplifies Huawei Cloud's efforts to deploy AI across key industries, including aviation and manufacturing. In October, it upgraded its AI agent development platform, enhancing core components, including MCP services, workflows, knowledge bases, and plugin frameworks, and adding more than 80 official prebuilt MCP tools to strengthen agent development and orchestration capabilities. Internationally, Huawei Cloud announced that the third availability zone of its Ireland region will come online in early 2026, supporting continued growth in cloud and AI demand across Europe.

Tencent Cloud accounted for around 9% of China's cloud infrastructure services market in Q3 2025. Growth remained constrained by limited availability of advanced AI computing resources, with Tencent adopting a balanced compute allocation approach, supporting customer-side AI capability delivery while advancing internal AI applications and product iteration. In November, Tencent Cloud launched HY 2.0 Think and HY 2.0 Instruct, enhancing complex reasoning and agent workflows while supporting stable, scalable enterprise AI deployment. In December, Tencent Cloud further enhanced its Agent Development Platform (ADP), upgrading capabilities across MCP plugins, workflow orchestration, knowledge management, and tooling. Separately, the company announced the commercial billing of its RAG-based models used within its agent development platform, marking a step toward scalable, production-grade agent deployment.

Omdia defines cloud infrastructure services as the sum of bare metal as a service (BMaaS), infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and container-as-a-service (CaaS) and serverless that are hosted by third-party providers and made available to users via the Internet.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (NASDAQ:TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients' strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260209034854/en/

Fasiha Khan: fasiha.khan@omdia.com

Eric Thoo: eric.thoo@omdia.com